27+ rrif withdrawal calculator

Web To use the calculator you need to enter the following. Web The RRIF Calculator shows what your annual minimum withdrawal will look like and how changing the amount you withdraw will affect your payment schedule.

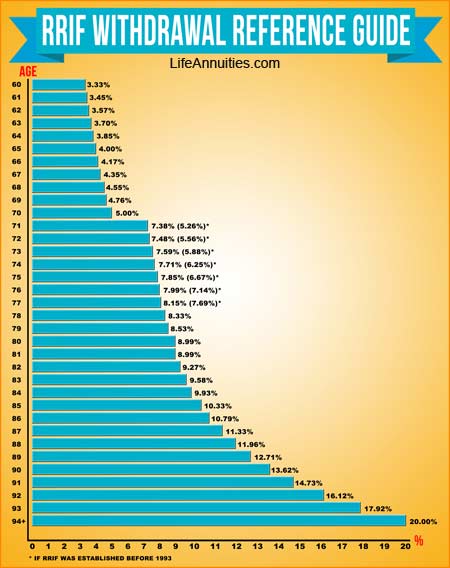

Rrif Withdrawal Schedule Rrif Rates Rrif Withdrawal Rules Lifeannuities Com

RRIF withdrawals occur at the end of the year.

. RRIF value maximum value 1000000 200000 Start RRIF at age 71. Your RRIF started after 1992. Ad Understand The Potential Impacts Of Withdrawing Early From A Retirement Account.

As you can see the annual percentage payouts gradually. Step 1 of 2. Web Using the correct strategy can save you from paying unnecessary taxes and fees and ensures you bring home more of your RRIF funds.

Ad Take Charge Of Your Retirement Savings Today With These Quick And Personalized Tips. Our Tools Can Help. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Web Know your RRIF Withdrawal in Two Steps Quickly estimate the minimum monthly and annual income withdrawal you could receive from your RRIF after you have converted. AMP value of RIF at beginning of the year X 1 90 -. Younger spouses age 65 Rate of return 600 Start payments in Type of payment Fixed payment 12000 Inflation rate.

Web This tool will calculate. Interest is compounded annually. Looking To Build A Retirement Plan For You Your Family.

Think of this as the value of your investment portfolio on Day 1 of your retirement. Youve Aced A Lot of Things In Life Now You Can Do the Same With Your Retirement. This RRIF ebook is yours free.

Web Education Cost Calculator. Web 32 rows RRIF Minimum Withdrawal The table below shows the RRIF minimum payout percentages for different ages. Get Started In Your Future.

Research Fund Options That Fits Your Investment Strategy. Web RRIF Payment Calculator RRIF Payment Calculate your RRIF payment and how long your RRIF will last. RRSP can only be opened if you have earned an income and have filed your taxes.

Use the RRIF Calculator to better understand your income potential and how long your RRIF has the potential to last. The mandatory age to convert an RRSP to a RRIF is an arbitrary setting set by the government that applies to everyone in the absence of their. Minimum withdrawals for your RRIF based on prescribed RRIF withdrawal factors as specified by the Income Tax Act once the RRSP is converted to a.

Your RRSP deduction limit is always 18 of your. Web This Retirement Income Fund Calculator assumes the following. Value of your investments.

Web RRSP Deduction Limits. Web Your RRIF Minimum Payout Percentage is 4 resulting in your minimum payout of 12000. Therefore if you withdraw 20000 instead you are charged.

Web 1 For customers under 71 years of age Annual Minimum Payment for non-qualifying RIF is calculated as follows. Web Our Retirement Income Fund Calculator provides withdrawal minimums and payment options based on the consumption and length of the investment. Web RRIF withdrawal table.

Web RRIF Payment 71 End RRIF at age 90 Use spouses age. Web A registered retirement income fund RRIF is a tax-sheltered account type that can only be funded and automatically converted from a registered retirement saving plan RRSP turning your hard earned savings into retirement income.

Rrif Withdrawals Youtube

Assumption Life For Individuals Assumption Life

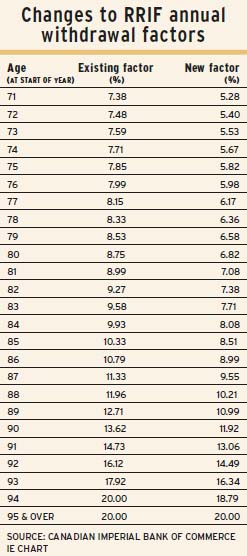

Rethinking Rrif Rates Investment Executive

Taxtips Ca Rrsp Rrif Withdrawal Calculator

Rrif Faqs Find The Answers You Need

Ebt Changes To Rrif Withdrawal Requirements For 2020

What Is A Rrif And How Does It Work In Canada For 2023

Rrif Calculator

Rrsp Withdrawal Rules Homeequity Bank

Rrif Calculator

Rrif Calculator Rbc Financial Planning

Rrif Faqs Find The Answers You Need

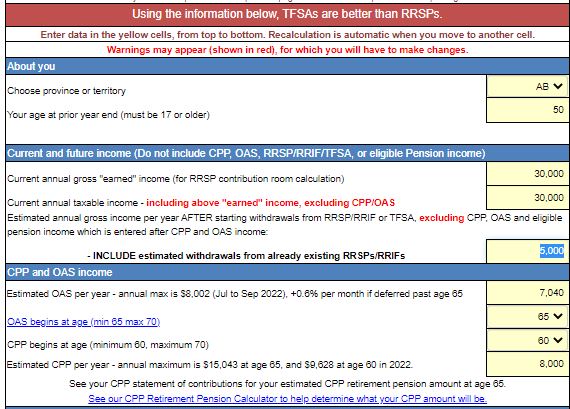

Taxtips Ca Tfsa Vs Rrsp Calculator

Annuity Articles Lifeannuities Com

Rrif Calculator Rbc Financial Planning

Rrif Calculator Empire Life

Rrif Payment Calculator Matco Financial